Hire Purchase (HP) car finance

Here’s what you need to know to help you decide if a Hire Purchase (HP) deal is right for you.

How HP works

HP is a finance agreement that allows you to spread the cost of buying a car over an agreed period of time. You pay a deposit followed by fixed monthly instalments until the agreement comes to an end. There also won’t be any excess mileage fees.

HP representative example. If your borrow amount is £6,000 with a deposit of £1,000, a selected term of 48 months, at a representative APR of 18.8%, you would pay £174.22 per month. Total charge for credit will be £2,362.56 and total amount payable is £9,362.56. CarMoney Limited can introduce you to a limited number of finance providers based on your credit rating and CarMoney will receive a commission for such introductions that can either be a % of the amount borrowed or a flat fee. This does not influence the interest rate you’re offered in any way. CarMoney is a broker not a lender. For full T&Cs please click here.

This calculator is for illustration purposes only. Your actual repayments could be lower or higher depending on your personal circumstances. The make, model and age of the car you’d like to purchase will also impact the final figure quoted.

A HP deal might be right for you if you:

- Want to own the car without making a large final payment when the agreement ends.

- Are happy to pay higher monthly payments than a PCP agreement as there isn’t a large final payment.

- Like to know exactly how much you’re paying every month.

You can estimate your monthly payments and find the right finance deal for you with a HP finance calculator.

When you apply for a HP agreement, a hard credit check will be completed, however the process varies between lenders.

What happens at the end of the HP agreement?

You’ll likely have to pay a small ‘Option to Purchase’ fee at the end of your agreement, which typically costs between £1 and £10. This covers the cost of transferring ownership of the car over to you.

After all monthly payments and the ‘Option to Purchase’ fee have been made, you’ll become the legal owner of the car.

You’ll likely have to pay a small ‘Option to Purchase’ fee at the end of your agreement, which typically costs between £1 and £10. This covers the cost of transferring ownership of the car over to you.

After all monthly payments and the ‘Option to Purchase’ fee have been made, you’ll become the legal owner of the car.

Popular questions about Hire Purchase

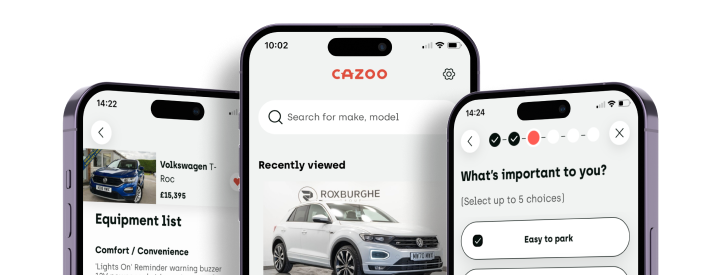

We’re switching gears and transitioning to a marketplace business model. We’re on a mission to provide a market-leading e-commerce platform tailored for buying and selling cars online.

If you’re looking for a car on a HP plan, you can use our CarMoney car finance calculator before you get started.

When you apply for a HP agreement, a hard credit check is completed to help lenders make a decision on your finance application. This type of check will be visible to other lenders and can have an impact on your credit score. New finance agreements are subject to status.

To complete your application, you’ll typically need to give some personal details, employment details, address history, bank account details and a copy of your photo driving licence.

Some lenders may also ask for information around your financial commitments to help work out whether you can afford the payments and to help maintain your financial wellbeing. This makes sure the lender is lending responsibly.

You have the right to end your HP agreement at any time by paying your outstanding finance. This is known as settling your finance agreement or ‘early settlement’.

If you’d like to settle your agreement early, you’ll need to contact the lender to receive a settlement letter confirming what you still owe (your settlement amount). This won’t include any remaining interest that you would have paid if you carried on with your agreement. This is known as an interest rebate. The amount of interest that you get back depends on where you are in the agreement.

Yes, you can. If you want to do this, it’s known as exercising your voluntary termination rights.

If you choose to cancel your agreement, you’ll need to make any remaining payments that are due up to this point. If the amount you’ve already paid for the car (including the deposit) is less than half the total amount payable, then you’ll need to make an additional payment to pay off the difference.

There may be extra charges if the car isn’t in good mechanical and cosmetic condition and is outside of reasonable wear and tear.

If you haven’t paid half of the outstanding amount and you’re experiencing financial hardship at any point during your agreement, some lenders may offer financial assistance.